What To Look For In An Amazon Seller Accountant

An Amazon seller accountant specializes in Amazon-based businesses alongside other companies such as eBay, Etsy, and Shopify. Suppose you sell your products almost exclusively through Amazon or another online retailer or use them as a platform to distribute them online. In that case, you will want Amazon accounting services from a professional who understands the online marketplace.

Do You Need an Accountant for E-commerce?

Every business, big or small, needs an accountant to provide bookkeeping services, including tax filing, tax management, and other financial decisions that help further the goals of your business. In a marketplace as varied, flexible, and ever-shifting as Amazon, having an accountant skilled in Amazon bookkeeping is paramount.

Amazon is a global marketplace, and you will need someone proficient in Amazon accounting to ensure you reap the most benefits possible from your business regardless of ever-changing market conditions.

Tax Law Knowledge

As a global entity, Amazon supplies your products and services to several states, provinces, countries, and territories. It would help if you had someone who understands the laws and regulations that could negatively impact your business and overall growth and success.

Tax laws, in particular, are essential, as different countries and territories may have specific rules and regulations regarding your products, services, or content. You must account for certain taxes and fees; researching them before every purchase can hurt your bottom line and disturb the business flow.

Bookkeeping

You need an accountant if you distribute your goods globally or even statewide, monitoring every individual purchase, cost, and profit alongside licensing or other regulations necessary to operate. An Amazon seller accountant can ensure the compilation of each fact in easy-to-access data that you can review and break down in real-time.

Ordinarily, accountants should always be the ones to conduct bookkeeping. Although many businesses choose to do it in-house, Amazon bookkeeping is a little more complex and involved, with several marketplaces needing their folders, data, and considerations simultaneously.

As a business owner, you could better spend that energy networking, marketing, and promoting your business while developing new products and services. Leave the paperwork to the Amazon seller accountant, whose experience can help minimize bookkeeping errors and ensure you have access to the necessary financial information that comprises your vast online marketplace.

Skills to Look For

Although it may be tempting to look online for an accountant who has worked on Amazon bookkeeping and click the first link, verifying they have the necessary skill set to ensure your business’ success is essential. It would help if you were looking for several factors when trying to find someone to handle your Amazon bookkeeping.

Experience with Amazon Sellers

Amazon sellers and other retailers who use online marketplaces should find an accountant who understands what it means to be an online store. Almost anyone can accomplish accounting, but knowing an online marketplace’s numerous variables, possibilities, and functions separates an accountant skilled in Amazon bookkeeping from a run-of-the-mill one.

Amazon, as well as Shopify, eBay, Etsy, and other online marketplaces, require a certain finesse and attention to detail to maximize each purchase order and sale. These marketplaces span continents, and even if you commit yourself to local business, there are overheads, shipping, and other distribution costs associated with using an online storefront too.

Amazon bookkeeping maximizes your profits and staunches unnecessary expenses, which is why you need an accountant skilled in the online marketplace.

Experience with Amazon Reporting Tools

Amazon has self-reporting tools business owners can use to monitor their operations and other widgets and software that allows for real-time reporting. Someone in charge of your Amazon bookkeeping should be able to understand and know how those tools operate so they can capitalize on the benefits. Being inexperienced with online marketing reports can lead to discrepancies and financial loss, such as data and information through transfers.

Communication Skills

Communication is the key to any successful relationship and should be one of the first things you recognize about an accountant responsible for your business’ success. If an individual cannot communicate effectively or promptly regarding your livelihood, that puts an unnecessary strain on your well-being and business. When you tell an accountant your needs, they should be able to understand them and communicate the requested information and results, such as financial information or online reports regarding sales, manufacturing, and distribution.

Furthermore, an accountant should be as excited about your product and services as you are and match your energy with their own to create something unique that can further your business goals and success.

Accessibility

Finally, your Amazon seller accountant should be easily accessible. An accountant responsible for your bookkeeping should have a live email and chat availability alongside onboarding calls that can help you facilitate and ensure business success. Important decisions can spring up at any time, and being unable to reach your financial team shouldn’t hinder you from making those profitable decisions. Alongside easily accessible contact, your accountant should provide step-by-step guides and tutorials for certain online functionality that can increase your skill in the online marketplace.

Bookkeeping Made Easy

Operating a business is challenging, and starting a business takes time and effort. Maintaining an online marketplace presence in such an advancing space is possible.

Link My Books has helped thousands of online sellers save time and money by automating their bookkeeping. Our in house accountants can help you get set up with a free 1:1 onboarding call and we can even connect you with trusted accountants who understand e-commerce too.

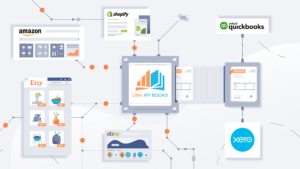

We support all the major sales channels including Amazon, Shopify, eBay and Etsy plus the top bookkeeping platforms such as Xero and QuickBooks. Each time you receive a payout from a sales channel, Link My Books breaks down all the sales, refunds, fees and most importantly taxes that made up the payout amount.

You end up with a clean summary entry posted to your bookkeeping software which matches exactly the deposit you received into the bank, making reconciliation of your entire month’s sales a quick and painless process.

Global Expertise

Our software works for businesses based in the United States, UK, and Australia. Our team of in house accountants and ex e-commerce sellers know the exact tax laws in each country’s provinces and territories, ensuring you receive the maximum benefit from your online retailing. We do this while providing easy-to-access support from real accountants, not third parties.

Users love us, as indicated by their testimonials. We guarantee you will love us once you see how you can reap the unmatched benefits of Amazon bookkeeping. If you want to capitalize on accurate reports, automated bookkeeping, and unmatched customer support, contact us today and enhance your online retailer experience.

Link My Books is a software that plugs into your Amazon account and Xero or QuickBooks to accurately automate your Amazon accounting. Not only does it save you time each month versus manual bookkeeping, it can also help you to reduce the likelihood of overpaying tax due to inaccurate accounting.

Community

Community