In the current state of affairs, it is quite straightforward for the UK to sell goods to Europe after Brexit in countries such as Germany and France within the European Union. Once the customer has purchased the item in the country, the goods will be fulfilled by a UK fulfillment center to the customer and then the company will charge either UK VAT or DE VAT, depending on whether the company has crossed the distance selling thresholds in DE (€100k) or France (€35k).

There aren’t any customs checks or tariffs involved in the process of moving goods cross-border because the seller just charges VAT at the checkout and files their VAT returns in the countries in which they have to file them. As a result, products will move easily cross-border.

As a result of an excellent customer experience, an overseas customer such as one who lives in Germany or France, for example, gets their goods in a timely manner and without any hidden charges. As a result, they are satisfied with their purchase and recommend your products to others.

If you offer your customers a great customer experience, the goods are delivered to them in a timely manner without any hidden charges. They have a good experience with your company and they will purchase your products again and recommend them to their family and friends.

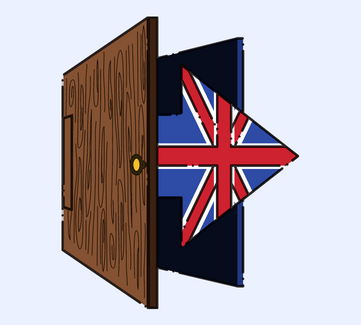

Despite the fact that Brexit is causing operational and logistical headaches for e-commerce retailers of all sizes, and across all industries, it cannot be denied. E-tailers from the EU are facing unprecedented challenges when it comes to selling to UK consumers and vice versa because of the rising shipping costs, delivery delays, new regulations, and the increasing amount of paperwork required.

UK Delivery difficulties

In order to fulfill the promise of having the goods delivered to customers in DE and FR in a timely manner, the retailer selling goods to Europe after Brexit will now have to deal with some serious challenges, causing the customer experience to suffer.

The UK is no longer be a member of the European Union Customs Union or VAT regime after 31 December 2020. This means that it will lose its VAT and customs simplification measures that make selling goods across the continent very simple. As a result, sellers will now have to bear in mind the following:

- Paying import duties

- Identifying HTS and Commodity Codes

- Completing Import Declarations

- Managing Increased Value Added Tax Liabilities

As part of the UK’s customs declaration process, all goods sold into the EU from the UK will have to be filled out in order for the goods to be allowed into the country. Additionally, if the consignment exceeds the sum of 150 Euros, there may be tariffs owed (if the shipment exceeds 150 Euros) which must also be paid alongside the customs declaration in order to release the goods.

Before EU customs will allow any company to ship their products to end consumers, they will have to understand what the HS codes associated with their goods are.

It is also the UK-based sellers who will be affected by the split, as they will need to register and charge VAT in France and Germany regardless of their distance selling thresholds, even if they have not crossed these thresholds yet. There will be a requirement that all goods sold have the correct French and German VAT attached to the sale, and that the company must file the return for these countries after the sale is completed.

The customer will have to pay the VAT if this is not handled correctly – and he will not be pleased at receiving that surprise from you.

A Brexit trade deal that does not include an exception for UK companies for fiscal representation can complicate things even further. In contrast to Germany, which does not require fiscal representation for companies selling within its borders, France and up to 18 other European Union member states require fiscal representation, which means that it will cost more to sell in these countries in compliance with regulations.

In order to offset some of these costs, the seller, therefore, is under additional pressure to make sure the customer has a positive experience and will buy from him/her again in the future.

In the absence of proper attention, these increased compliance requirements will have the following consequences:

- Customs delays and fees

- Increased costs

- Potential VAT fines

- Bad customer service

Cross-border shipping in Europe after Brexit

However, there is good news for merchants in this industry as they can overcome the challenges above and prevent the disadvantages listed above. This is because merchants can take the necessary steps right now in order to secure their presence in the largest e-commerce markets in Europe and unlock their full potential for growth.

To achieve optimal cross-border fulfillment, it is essential to split up your inventory and store a portion of it in a fulfillment center within the European Union in order to optimize cross-border fulfillment. The fact that online merchants from the UK will need to register for VAT if they are to trade with European Union countries will not add any further complexity from a tax perspective since they will have to register for VAT for trading EU countries.

It is important to remember, however, that building and managing your own fulfillment center or logistics center requires a considerable amount of resources and is often times quite expensive. Due to this, it is recommended that you outsource your order fulfillment process to a third-party logistics provider and rely on its network of international fulfillment partners. The extensive network of fulfillment centers that Byrd operates throughout the countries of Germany, Austria, France, Netherlands, and the UK, allows Byrd to provide fully integrated cross-border fulfillment solutions.

E-commerce retailers have 2 major advantages when they opt for warehousing and logistics and fulfillment solutions like that with WAPI:

1) Low shipping costs. Retailers are able to deliver their inventory in bulk to the respective fulfillment center located in the EU, as well as fulfilling all the necessary customs formalities for such a large quantity of merchandise at the same time in order to minimize shipping costs. Due to the fact that the products are declared in the EU, they are able to be shipped at a low cost across the EU, which allows online stores to continue to provide free shipping, which results in improved conversion rates as well.

2) In addition to fast shipping, you can also declare your products as well as store them within the EU. Thus, parcels will not be subject to customs checks since they are being shipped to EU countries. You will be able to keep your delivery times smooth and short if you jump on the fast lane when you fulfill orders, which will result in higher customer satisfaction as a result.

In the event that the returns process is substandard, many customers will complain about the quality of service and the overall order experience, which will overburden customer support staff. You will be able to avoid bureaucratic bottlenecks as well as dissatisfied customers if you store your inventory in a fulfillment center located in the European Union.

Storing goods in Europe

There is a second step that your business needs to take in order to optimize cross-border fulfillment by gaining the necessary documentation for customs declaration purposes, including an EORI number, VAT number, and HS code.

1) In order to import goods into the EU, you are required to have an EORI (Economic Operators Registration and Identification) number which is required to be registered with the EU Customs department. In addition, it can take up to 10 working days to obtain the EORI number as it is required by the EU Customs department.

2) It is important that you register for a VAT number (Value Added Tax) number for your business when you want to manage selling goods to Europe after Brexit. The whole procedure can take up to eight weeks and you should expect it to take this long.

3) It is also important for the customs declaration to contain the HS (Harmonised System) code used for identifying products and calculating customs duties based on the price and margins of the products. In addition, here are the things that you need for the customs declaration:

- The commodity code uniquely identifies a shipment.

- The origin and the destination of the cargo.

- The shipper and the receiver of the freight.

- The nature of the merchandise, the amount, and the packaging.

- The transport method used.

- Any certificates or licenses that are applicable.

- The country of origin of the products.

Fulfillment center’s requirements

You need to work closely with your UK-based fulfillment center in order to be prepared for Brexit. If they don’t have this information, your fulfillment house won’t be able to ship your goods overseas on your behalf, so be sure that the UK-based fulfillment house has it:

- A description of the item

- The country of production

- The customs code for the item

- The monetary value of the goods

- The currency of the transaction

UK Fulfillment advices

You should always ask your fulfillment company in the UK if the postage charges for international shipments are going to fluctuate. Your fulfillment company should let you know if the postage charges change if they have been notified in advance. Many couriers may make changes without notice, so you should factor this into your budget.

You are far more likely to feel prepared if you work with a third-party fulfillment house you can rely on, like WAPI. Order fulfillment is all we do. We can do it professionally and we can leave you to focus on what you do best, which is selling your products and providing service to your customers.

In order to learn more about the fulfillment solutions of WAPI, contact our team and find out if we might be able to help you with your order fulfillment needs.

Selling Goods To Europe After Brexit – Solutions

In order to help you, we can provide a variety of solutions depending on the needs and size of your business:

- Search, find and select the right 3PL partners, including warehousing, fulfillment & last-mile delivery providers.

- Provide easy access to and management of a wide range of local warehouses and logistic networks through a single API, allowing you to simplify cross-border sales and distribution through the ease of connection and management.

- You will be able to integrate your logistics network and partners into one platform and save 100 hours of IT work per partner, regardless of what software solution you are currently using.

- As a result of Brexit uncertainty, it is necessary for inventory management to forecast demand in order to add more predictability and aid inventory management.

WAPI network connects hundreds of warehouses and fulfillment centers across the EU. We store your products at our fulfillment centers & offer picking, packing and shipping and we can help your business to solve the problem of selling goods to Europe after Brexit.

Community

Community